Bank First Cards

Visa Credit and Debit Cards

Looking for a new card? We have a range of cards available.

Visa Classic Credit Card

Offering a low interest rate, no annual fee and up to 55 days interest free*.

Visa Platinum Credit Card

Offering a highly competitive interest rate on purchases, exclusive Visa Platinum privileges and up to 55 days interest free*.

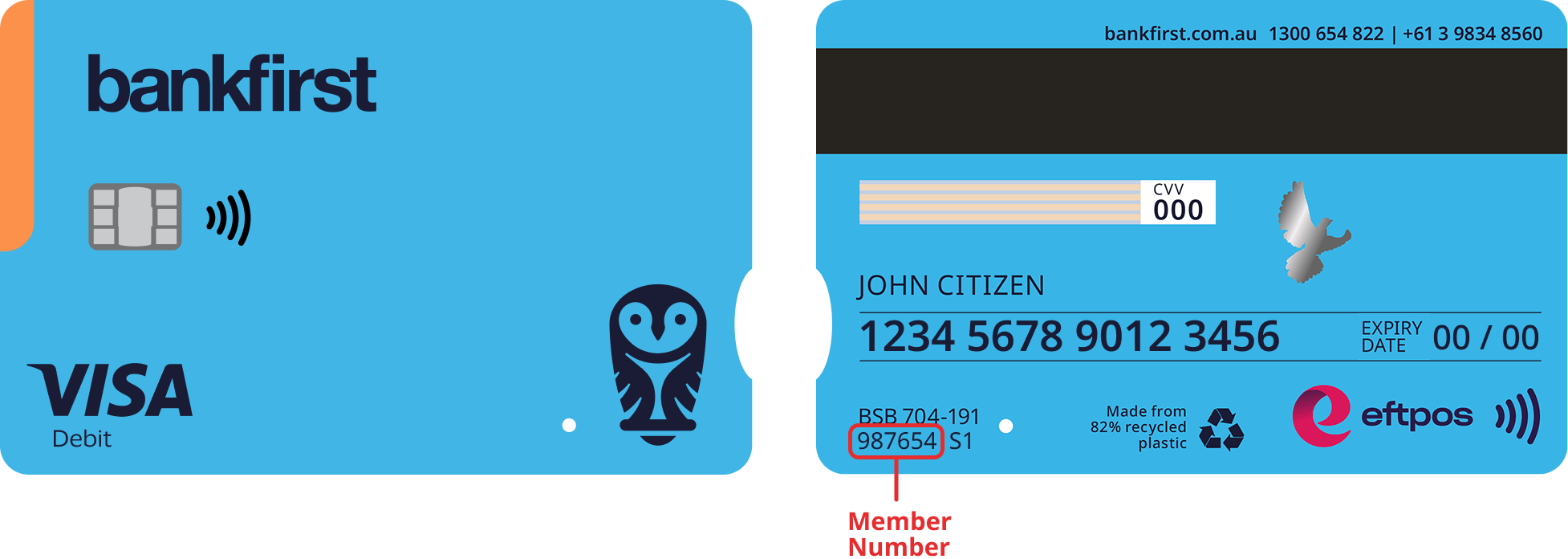

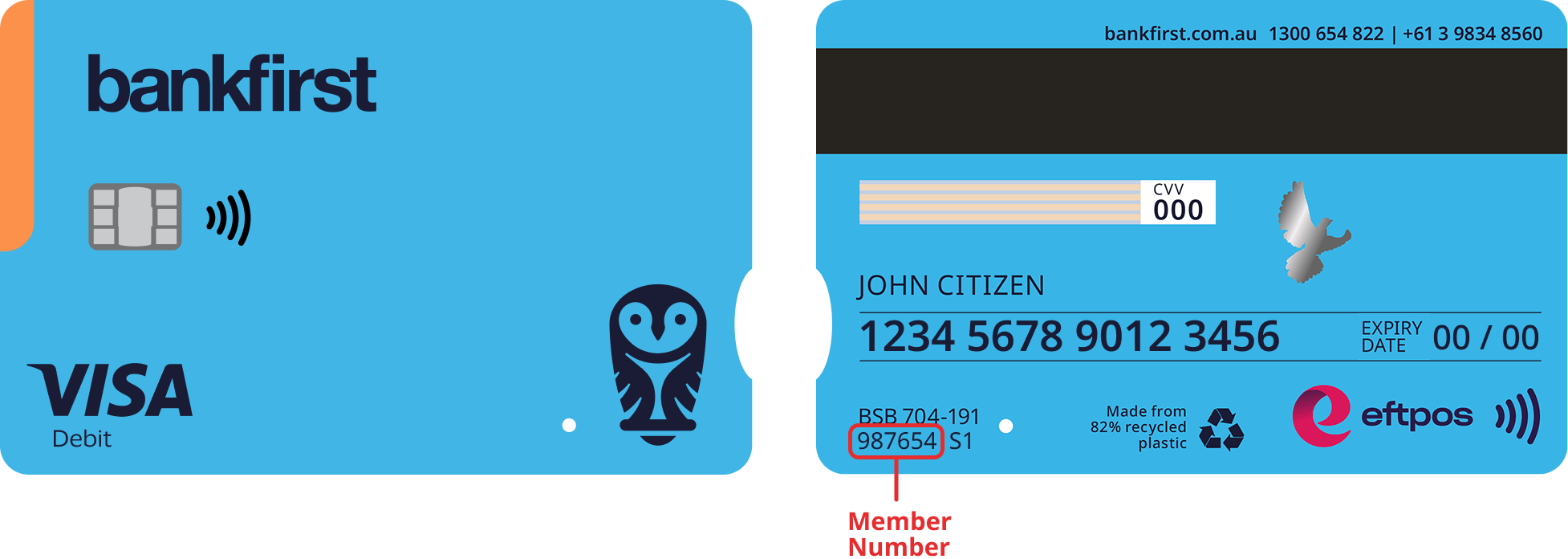

Visa Debit Card

The Visa Debit Card is not a credit card, but allows purchases to be directly debited from your transaction account.

Managing your card

You can now select the PIN on your Bank First card via Internet Banking or Mobile Banking App as long as you have SMS One Time Password enabled.

It provides you with the convenience of selecting a PIN via a secure channel anywhere/anytime. You won’t need to know your existing PIN to change it.

If you're not yet registered for internet banking, please contact us.Learn more about how to change your PIN.

Your Bank First Visa Credit and Debit Cards are accepted anywhere the Visa logo is displayed in Australia or overseas.

You can also use your Visa Credit and Debit Cards at ATMs and POS terminals across Australia or to make purchases over the phone or via the internet.Lock your card immediately or put a temporary lock on it in the Bank First App. You can also lock your card while you look for it, which restricts all purchases and withdrawals.

After reporting a card lost or stolen via our Bank First App you have the option to re-order your card immediately. Follow these instructions:

Login to the Bank First App

Select Cards

Swipe to find your Card

Select Need help with your card?

Select 'Lost your card', 'Card been stolen' or 'Damaged your card' and follow the prompts.

Select if you would like a replacement card.

Your card will be stopped immediately.

You can also contact Visa Global Assistance.

Learn more about managing your cards.

Mobile wallets are a fast, secure and easy way to pay.

Use your mobile device to make every day purchases anywhere you can Tap and Pay. All you need is a Bank First Visa Debit Card or Credit Card and a compatible Apple or Android device.

Set up Apple Pay or Google Wallet today to avoid contact with payment terminals, PIN pads or cash.Find out more about mobile wallets.

Find out which countries support Apple Pay.

Find out which countries support Google Wallet.

Visa payWave lets you make contactless payments for purchases under $100 by simply tapping the card on the payment terminal at participating retailers.

Click here for information on payWave.Please complete a Visa Transaction Dispute Form if you wish to dispute a transaction on your Bank First Visa Card. If you need to discuss your request first, please contact us.

Before submitting this form we recommend:

Searching the business/merchant name online. The business name on your bank statement may differ to their trading name and this may help you identify what the purchase relates to.

Contacting the merchant first to resolve any issues. If you are unsuccessful in contacting the merchant, please proceed with completing the form.

If your card won't work when overseas you can contact us via phone +613 9834 8560 (overseas) Monday – Friday 8am-6pm AEDT (excluding Public Holidays) to seek assistance. You can also lodge an enquiry via our online form.

For non-urgent issues email us at info@bankfirst.com.au.

Frequently asked questions

No. A Visa Debit Card is not a Credit Card.

The Visa Debit Card is linked to your transaction account and can only use the funds available in that account.

Your Mutual Bank is now required by Visa International to automatically register your Debit/Credit Card for the Verified by Visa Service. This Service is designed to provide added protection when performing purchases online at merchants who authenticate via Verified by Visa. Not all online merchants are registered for this service so Members should exercise caution when purchasing over the Internet.

When shopping online at a merchant who uses the Verified by Visa Service, you may be prompted to enter information that is matched against the Mutual Bank’s records. The merchant is not aware of the information being asked, so you can be ensured the process is secure. Once the correct responses are entered, the Verified by Visa Service will authenticate you as the authorised card holder and complete your online transaction.

For more information, browse the Verified by Visa FAQs.You can find your Member Number in several ways:

Your bank statements

At the back of your Visa Debit Card

Children from the age of 12 have the option to have a Visa Debit Card on their account.

If the account holder is between the age of 12-14, they must have a parent or guardian who is an authorised signatory on the account approve the Visa Debit Card. Learn more.

As of June 2019, Bank First no longer offers ATM Cards, and has replaced them with Visa Debit Cards.

Additional functionality - due to the additional features of the Visa Debit Card and the limited access of the ATM Card we have made the decision to transition ATM Cards to Visa Debit Cards.

Customer purchase protection with Visa's zero liability policy - Visa cardholders are not liable for fraudulent charges or unauthorised purchases as long as they did not participate in the transaction.

Verified by Visa - when you shop online, we can ask you for additional security information for higher risk transactions to make sure the card isn't being used without your permission.

Account Funding Transaction, or AFT, is a payment method available via the Visa network that allows you to debit your Bank First card account to fund another account in your name or a third party.

An AFT is available on your Visa Debit and/or Credit cards and is processed as a Cash Advance.

Interest charges and Cash Advance fees apply to AFT’s using your Visa Credit Card. Please refer to our Terms & Conditions: Part B – Fees and Charges for further information.

An AFT is a fee-free transaction on your Visa Debit card account.

Our Terms and Conditions should be considered before acquiring a product.

*Does not apply to cash advances.